KW Greater Solutions

Get Every Listing Market-Ready

KW Greater Solutions, Powered by HouseAmp, provides fast and easy financing to help homeowners make improvements before they sell, with no out-of-pocket expenses.*

-

Equity-based funding for homeowners up to $400k -

No-interest for 60 days, No payments for 1 year* -

Use and refer your preferred service pros

Log In

Create Agent Account

Link for Homeowners

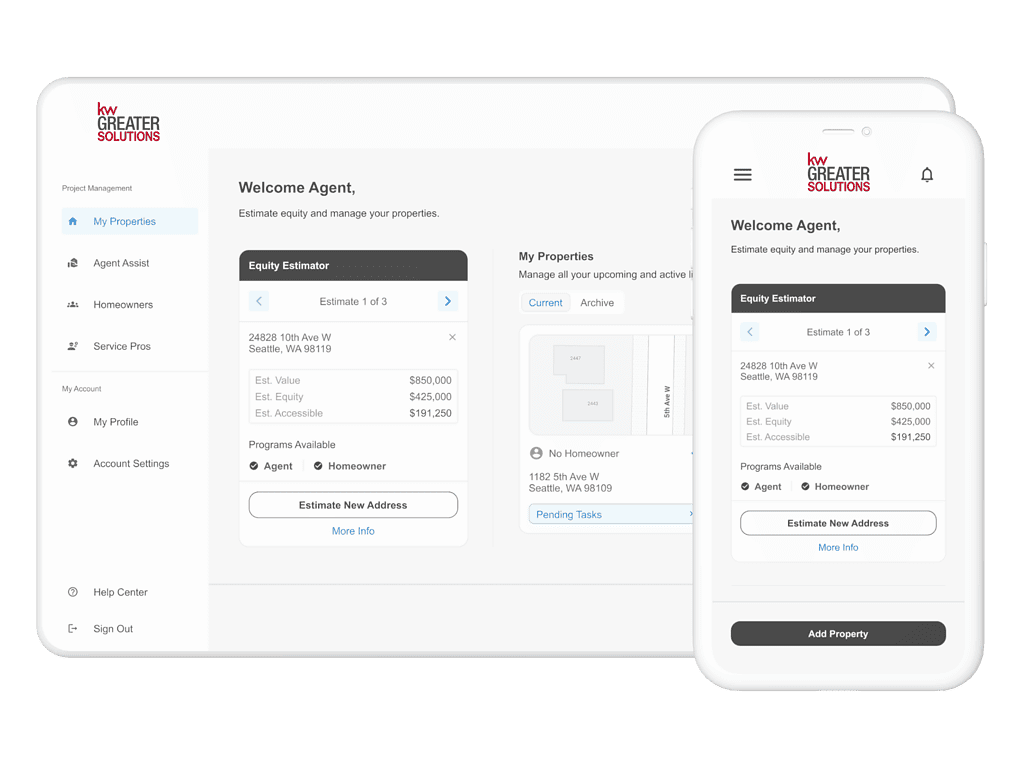

Manage Everything in the Platform

From pre-listing tasks to post-inspection repairs, the platform helps keep everyone on the same page throughout the selling cycle.

Transparency Into the Process

-

Invite homeowners to apply for loans and start projects -

Your clients can apply for a loan any time—even after listing -

Funds available in days—not weeks! -

No out-of-pocket fees, sellers pay at closing* -

Clients receive invoices and can approve for payment in 1-click -

Real-time visibility and access to client project progress

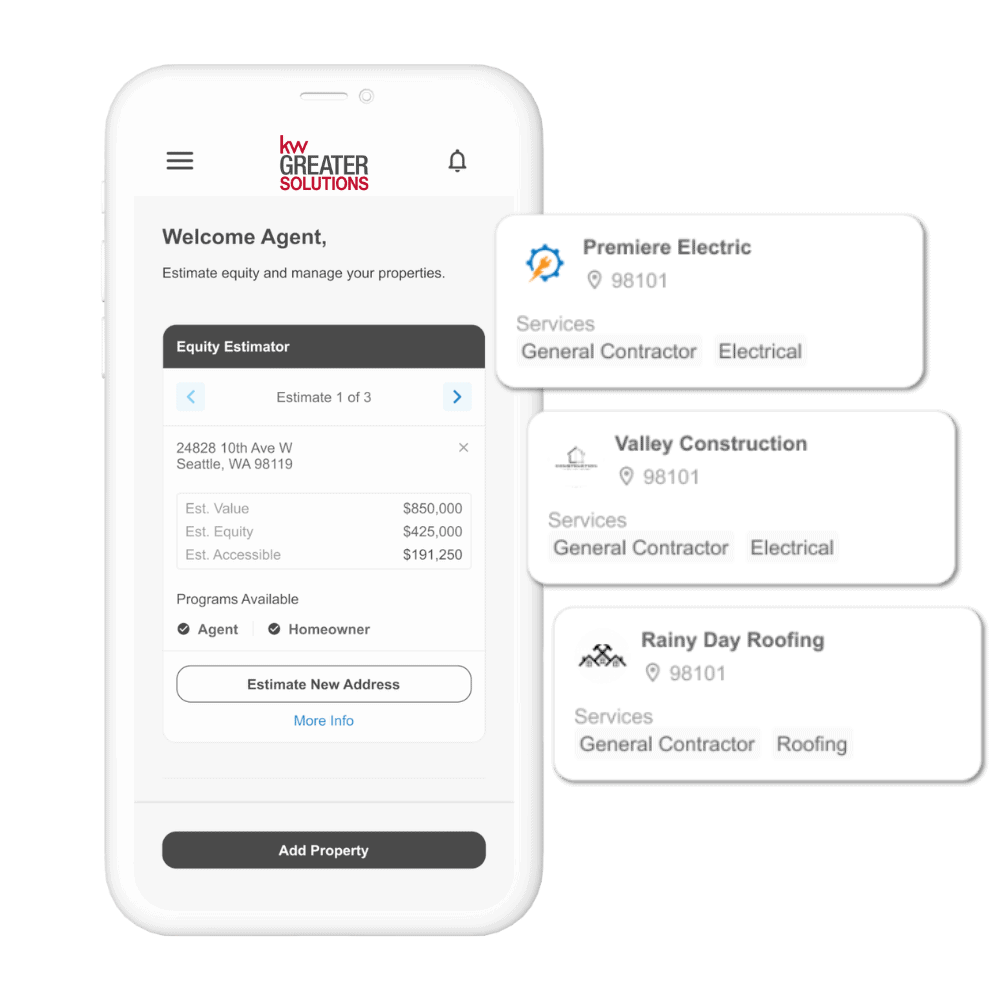

Your Dashboard Is Your Own

-

Check client eligibility and available equity using the calculator -

Leverage the calculator as a new business generation tool -

Easily maintain and refer your curated list of service pros

Agent Stories

How Sherry Used It:

She was able to help her elderly client into an assisted living facility and allowed the home renovation projects to be completed.

-

Sherry C, Tacoma WA

How Victor Used It:

He helped a military family make their last minute cross-country move as seamless as possible.

-

Victor M, Olympia WA

How Maureen Used It:

Her clients did not have a lot of time to sell a house that needed a lot of work. She was able to get providers on board and paid quickly.

-

Maureen D, Bainbridge Isl. WA

For more information, check out our agent resources

Need Help? Articles, answers, and live chat can be found at the Help Desk

Visit the Help Desk

© 2024 Powered by HouseAmp. All Rights Reserved.

Privacy Policy | Cookies(877) 537-2643

*Loans are available through HouseAmp’s licensed lending partners. All loans are subject to approval based on lenders’ underwriting criteria. Homeowners can apply for a 24-month open-ended home equity line of credit, which includes an origination fee, a fixed interest rate, and up to 60 days no-interest period. The loan allows homeowners to access funds for home improvements and sale-related expenses for a draw period of up to six months. Disbursement of funds within the HouseAmp platform is subject to HouseAmp’s Terms of Use. Repayment of the loan, including the outstanding balance, any accrued interest, and fees, is required either upon the sale of the house or within 24 months of the origination date, whichever comes first. Monthly interest payments will be required if the loan exceeds 12 months. The outstanding loan balance and any unpaid, accrued interest will be due on the 24th month.

All Program terms are subject to change based on the credit application and associate lenders in the market.