KW Greater Solutions

Improve Now, Pay Later

Leverage your home equity to make improvements before you sell, and defer all costs until closing*

-

Fast Funding: Quick application and approval process -

No-interest for 60 days, No payments for 1 year* -

Use your favorite service pros, or find new ones on the platform

Ready to get started? Ask your KW Greater Seattle Agent to invite you!

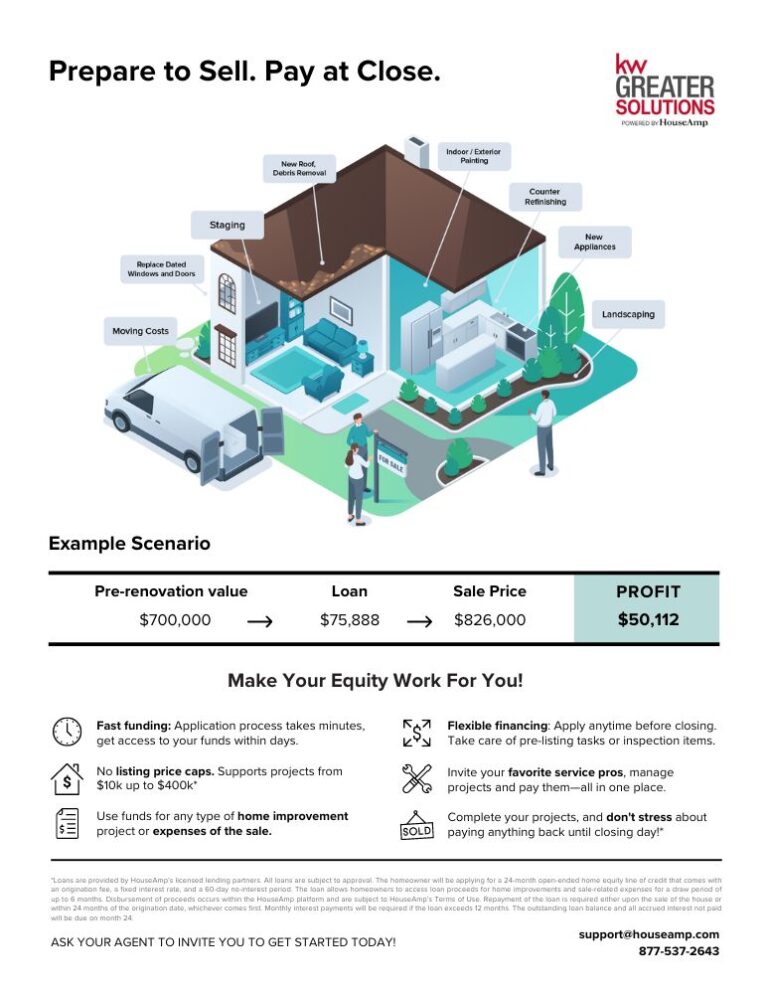

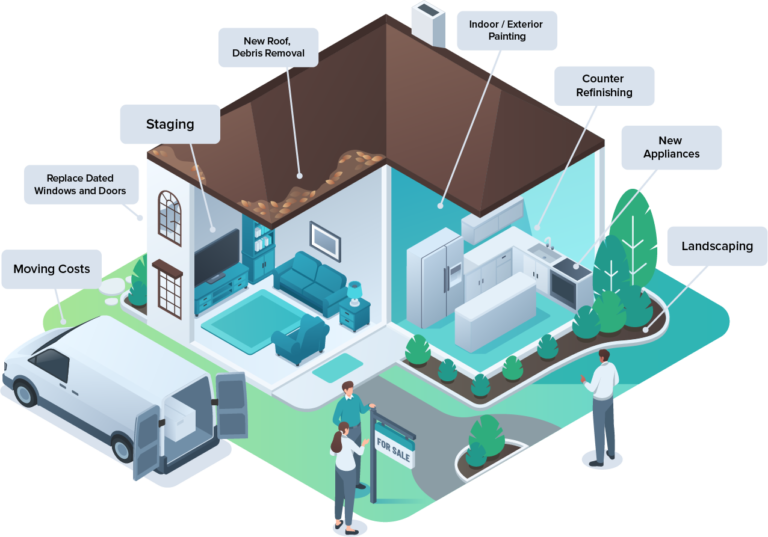

More Flexibility Than Ever

Use funds for sale-related expense that go beyond home improvements…

-

Staging / Decluttering -

Cleaning & Organizing -

Painting

-

New Appliances

-

New Flooring -

Landscaping -

New Roof

-

Furnace / HVAC

-

Moving Expenses -

Short-Term Housing -

Post-Inspection Repairs

-

Whatever Helps You Sell!

How it Works

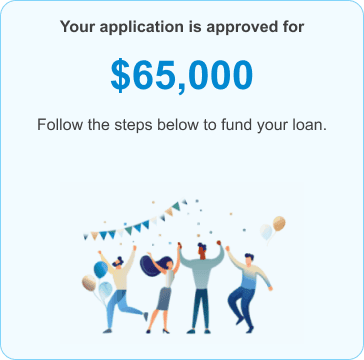

Super-Fast Funding

Our quick application process will get you funded and working on projects within days—not weeks.

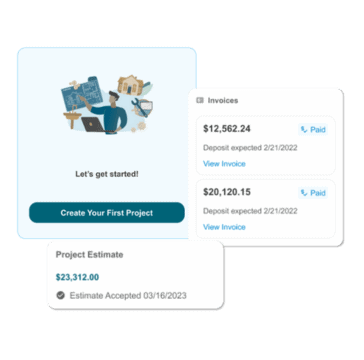

Freedom & Flexibility

Homeowners and their brokers can work with their preferred vendors on whatever projects they choose.

Max Transparency

The platform helps keep everyone on the same page throughout the selling cycle.

Pay When You Sell!

Complete your projects and list your home with no out-of-pocket expenses, then pay it off at close.*

FAQ

How does pay-later funding work?

Loans are provided by HouseAmp’s licensed lending partners. All loans are subject to approval. The homeowner will be applying for a 24-month open-ended home equity line of credit that comes with an origination fee, third-party processing fees, a fixed interest rate, and a limited no-interest period. The loan allows homeowners to access loan proceeds for home improvements and sale-related expenses for a draw period of up to 6 months. Disbursement of proceeds occurs within the HouseAmp platform and are subject to HouseAmp’s Terms of Use. Repayment of the loan is required either upon the sale of the house or within 24 months of the origination date, whichever comes first. Monthly interest payments will be required if the loan exceeds 12 months. The outstanding loan balance and all accrued interest not paid will be due on month 24.

Are there any fees associated with obtaining a loan?

There are no out-of-pocket fees. Our lenders charge an origination fee of 1.99% which is deducted from the available loan proceeds. In addition, our lenders charge nominal, customary fees for credit reports, flood determination, notary, document preparation, and document recording. These fees will also be deducted from the available proceeds.

Loans are provided by third-party lenders. The lender specifies the fees and terms that are associated with loans they offer.

Is there a minimum credit score?

There is a minimum credit score of 650.

What types of services can be paid for from the loan proceeds?

Loan proceeds can be used for improvements to get your home ready for sale and other expenses of sale. Any service providers involved with the sale or improvement of the home can sign up and be a part of the process. The platform supports various services, from improvements to staging to moving and storage costs. A list of service categories is available on the platform dashboard when you create your account.

A list of service categories is available on the dashboard when you create your account.

Can I work with my own service providers?

Any service provider can be invited to create an account on the platform to start working with you on projects. The platform provides service providers with efficient project management, fast and easy payments every Friday, and instant access to funds via ACH electronic deposit. In addition, service providers gain access to the vast HouseAmp homeowner network for referrals and leads. Service providers and others using the HouseAmp platform who are requesting payment from a homeowner’s available loan proceeds are subject to a 3.49% platform fee as described in the HouseAmp Terms of Use. The fee is equivalent to most credit card fees.

For more information, see Inviting a Service Provider.

Is there a minimum or maximum loan size?

Our lenders require a minimum loan of $10,000. The maximum loan amount available is $400,000. All loans are subject to approval and based on credit and available equity in your home.

Can I apply for a loan after my property is listed?

Yes! Pay-later funding is available for pre-listing needs as well as last minute or inspection-related repairs.

What Homeowners Are Saying

“The platform was so easy to manage. I can’t tell you how much it lowered my stress to not have to worry about payments while my house was on the market.”

-

Kai S., Homeowner

“My sellers were able to prepare their home, list their home, and sell their home in 3 weeks, for the highest price in the neighborhood, and this program was critical in making it happen.”

-

Maureen D., Realtor

“Our agent recommended this for repairs before listing our home. It was easy to use and keep everyone on the same page. We have already recommended it to a friend getting ready to list!”

-

Nicole and David S., Homeowners

Ready to Get Started? Ask your KW Greater Seattle Agent to invite you!

© 2024 Powered by HouseAmp. All Rights Reserved.

Privacy Policy | Cookies(877) 537-2643

*Loans are provided by HouseAmp’s licensed lending partners. All loans are subject to approval. The homeowner will be applying for a 24-month open-ended home equity line of credit that comes with an origination fee, a fixed interest rate, and a limited no-interest period. The loan allows homeowners to access funds for home improvements and sale-related expenses for a draw period of up to 6 months. Disbursement of funds within the HouseAmp platform is subject to HouseAmp’s Terms of Use. Repayment of the loan is required either upon the sale of the house or within 24 months of the origination date, whichever comes first. Monthly interest payments will be required if the loan exceeds 12 months. The outstanding loan balance and all accrued interest not paid will be due on month 24.